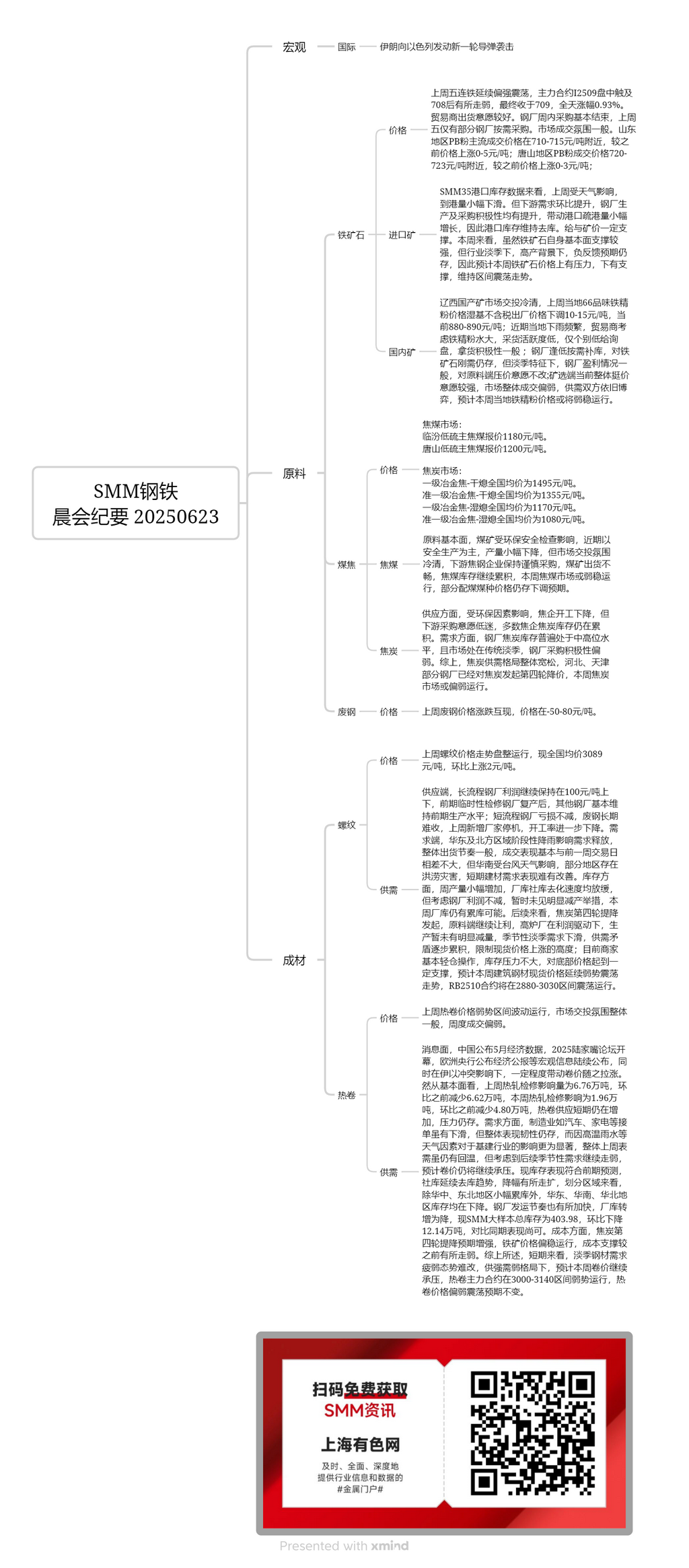

Domestic ore:

The domestic ore market in western Liaoning was sluggish. Last week, the ex-factory price (wet basis, excluding tax) of Fe66% iron ore concentrates in the region fell by 10-15 yuan/mt to 880-890 yuan/mt. Frequent rainfall in the area recently has led traders to be wary of the high moisture content in iron ore concentrates, resulting in low purchasing activity. Only a few low-price inquiries were made, and the willingness to purchase was generally moderate. Steel mills restocked on dips as needed, and there was still a rigid demand for iron ore. However, due to the characteristics of the off-season and the average profitability of steel mills, their desire to drive down prices on the raw material side remained unchanged. Mines and beneficiation plants currently have a strong reluctance to budge on prices. Overall market transactions were weak, and there was still a tug-of-war between sellers and buyers. It is expected that the local iron ore concentrate prices will remain in the doldrums this week.

Imported ore:

Last Friday, the DCE iron ore futures contract extended its sideways movement. The most-traded I2509 contract touched 708 during the session before weakening slightly and closing at 709, up 0.93% for the day. Traders showed a good willingness to sell. Steel mills' weekly procurement was largely completed, and only some steel mills made purchases as needed last Friday. The market trading atmosphere was generally moderate. The mainstream transaction prices of PB fines in Shandong were around 710-715 yuan/mt, up 0-5 yuan/mt from the previous prices. In Tangshan, the transaction prices of PB fines were around 720-723 yuan/mt, up 0-3 yuan/mt from the previous prices. According to SMM's 35-port inventory data, port arrivals declined slightly last week due to weather impacts. However, downstream demand increased MoM, and the production and purchasing enthusiasm of steel mills both improved, driving a slight increase in port pick-up volume. As a result, port inventory continued to destock, providing some support to ore prices. Looking ahead this week, although iron ore has strong fundamental support, under the backdrop of the industry's off-season and high production, there are still expectations of negative feedback. Therefore, it is expected that iron ore prices will face pressure from above and support from below, maintaining a fluctuating trend within a range.

Coking coal:

The quoted price of low-sulphur coking coal in Linfen is 1,180 yuan/mt, and in Tangshan, it is 1,200 yuan/mt. Regarding the fundamentals of raw materials, coal mines have been focusing on safe production recently due to the impact of environmental protection and safety inspections, resulting in a slight decline in production. However, the market trading atmosphere is sluggish, and downstream coking and steel enterprises remain cautious in their purchases. Coal mines are experiencing poor sales, and coking coal inventory continues to accumulate. This week, the coking coal market may remain in the doldrums, and there are still expectations of price reductions for some blended coal varieties.

Coke:

The nationwide average price of premium metallurgical coke (dry quenching) is 1,495 yuan/mt. The nationwide average price of high-grade metallurgical coke (dry quenching) is 1,355 yuan/mt. The nationwide average price of premium metallurgical coke (wet quenching) is 1,170 yuan/mt. The nationwide average price of high-grade metallurgical coke (wet quenching) is 1,080 yuan/mt. In terms of supply, due to environmental factors, the operating rates of coking enterprises have declined. However, downstream purchase willingness remains low, and coke inventory continues to accumulate at most coking enterprises. Demand side, steel mills' coke inventories are generally at medium to high levels, and the market is in the traditional off-season, with steel mills showing weak enthusiasm for procurement. In summary, the overall supply-demand pattern for coke is loose. Some steel mills in Hebei and Tianjin have already initiated the fourth round of price reductions for coke, and the coke market may be in the doldrums this week.

Rebar:

Last week, rebar prices consolidated, with the current nationwide average price at 3,089 yuan/mt, up 2 yuan/mt MoM. On the supply side, blast furnace steel mill profits continued to hover around 100 yuan/mt. After the resumption of production at steel mills that had undergone temporary maintenance, other steel mills have largely maintained their previous production levels. EAF steel mills continue to face losses, and steel scrap has been difficult to procure for an extended period. Last week, additional manufacturers halted operations, leading to a further decline in the operating rate. On the demand side, intermittent rainfall in east China and northern regions affected demand release, with overall sales pace being average and transaction performance remaining largely similar to the previous trading week. However, in south China, affected by typhoon weather, some areas experienced flooding, making it difficult for short-term construction steel demand to improve. In terms of inventory, weekly production increased slightly, and the destocking speed of both in-plant and social inventories slowed down. However, considering that steel mill profits remain unchanged, no significant production cuts have been observed for the time being, and there is still a possibility of inventory buildup at steel mills this week. Looking ahead, with the initiation of the fourth round of coke price reductions, raw material costs continue to decline. Driven by profits, blast furnace steel mills have not significantly reduced production yet. With seasonal off-season demand declining, the supply-demand imbalance is gradually accumulating, limiting the upside potential of spot prices. Currently, merchants are generally operating with light inventories, and inventory pressure is relatively small, providing some support to bottom prices. It is expected that the spot price of construction steel will continue to exhibit a weak oscillating trend this week, and the RB2510 contract will fluctuate rangebound in the 2,880-3,030 range.

HRC:

Last week, HRC prices fluctuated within a weak range, with the overall market trading atmosphere being average and weekly transactions being weak. On the news front, China released its May economic data, the 2025 Lujiazui Forum opened, and the European Central Bank released its economic bulletin, among other macroeconomic information. Meanwhile, influenced by the Israel-Iran conflict, HRC prices were driven up to some extent. However, from a fundamental perspective, the impact from maintenance on hot rolling last week was 67,600 mt, a decrease of 66,200 mt from the previous period. This week, the impact from maintenance on hot rolling is expected to be 19,600 mt, a decrease of 48,000 mt from the previous period. HRC supply is still increasing in the short term, and pressure remains. On the demand side, although orders for manufacturing industries such as automobiles and home appliances have declined, overall performance remains resilient. However, due to weather factors such as high temperatures and rainfall, the impact on the infrastructure industry is more significant. Although overall apparent demand showed some recovery last week, considering the continued weakening of seasonal demand in the future, it is expected that HRC prices will continue to face downward pressure. Current inventory performance is in line with previous forecasts, with social inventories continuing the destocking trend and the decline widening. By region, except for slight inventory buildup in central China and north-east China, inventories in east China, south China, and north China are all declining. The shipping pace of steel mills has also accelerated, with in-plant inventory shifting from increase to decrease. Currently, the total inventory of SMM's large sample stands at 403.98, down 121,400 mt MoM, showing moderate performance compared to the same period last year. On the cost side, expectations for the fourth round of coke price reductions have strengthened, while iron ore prices have remained relatively stable, leading to a weaker cost support than before. In summary, in the short term, it is difficult to change the weak demand for steel during the off-season. Under the pattern of strong supply and weak demand, it is expected that the coil prices will continue to face pressure this week. The most-traded HRC contract will remain in the doldrums within the 3,000-3,140 range, and the expectation for HRC prices to be in the doldrums remains unchanged.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)